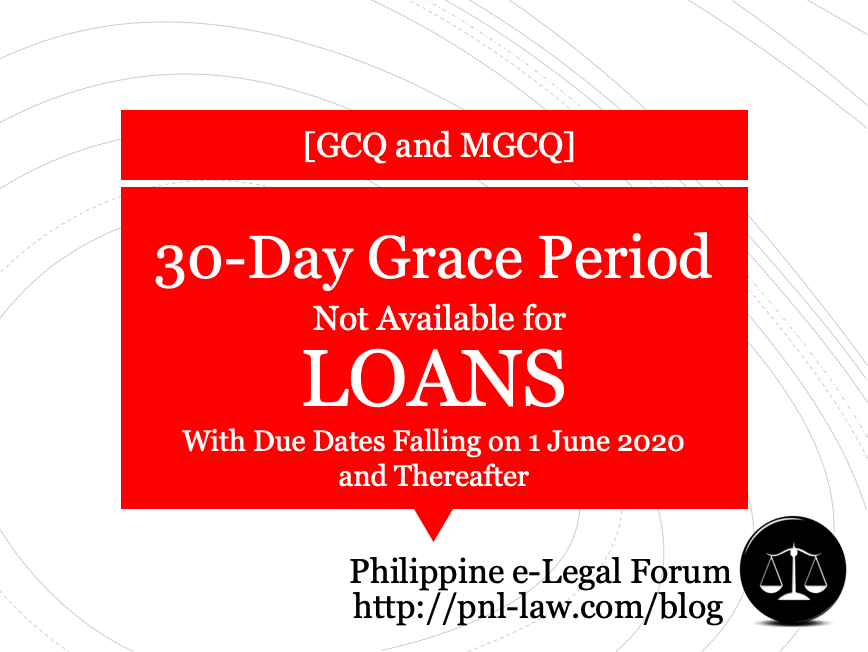

[The Department of Finance (DOF) and the Bangko Sentral ng Pilipinas (BSP) did not issue any new guidelines, which means that the original Implementing Rules and Regulations covering the 30-day grace period for loans remain the same. The rule is different for rents. Loans with due dates falling before 1 June 2020 still enjoy the 30-day grace period, but loans with due dates falling on 1 June 2020 and thereafter do not enjoy such benefit. This is clear in the latest Frequent Asked Questions (FAQ) of the BSP, reproduced below for the purpose of disseminating the information.]

BANGKO SENTRAL NG PILIPINAS

OFFICE OF THE GOVERNOR

MEMORANDUM NO. M-2020-045

To: All BSP-Supervised Financial Institutions (BSFIs)

Subject : Frequently Asked Questions (FAQ) IV on the Implementing Rules and Regulations (IRR) of Section 4(aa) of Republic Act No. 11469, Otherwise Known as the “Bayanihan to Heal As One Act” (Bayanihan Act”)

The following items shall be added to the FAQs on the IRR of Section 4(aa) of Republic Act (R.A.) No. 11469 or the Bayanihan Act issued under Memorandum No. 2020-018 dated 6 April 2020, Memorandum No. 2020-028 dated 22 April 2020, and Memorandum No. 2020-042 dated 18 may 2020:

1. How will the classification of the National Capital Region (NCR) under General Community Quarantine (GCQ) and certain parts of the country under Enhanced Community Quarantine (ECQ)/Modified ECQ effective 1 June 2020 affect the application of the mandatory grace period provided under the Bayanihan Act?

- The 30-day mandatory grace period under the Bayanihan Act shall no longer apply effective 01 June 2020, pursuant to the declaration of the Inter-Agency Task Force for the Management of Emergency Infectious Diseases (IATF) under its Resolution No. 40, dated 27 May 2020, which already places a majority of provinces and cities under GCQ or Modified GCQ (MGCQ). Therefore, all loan payments with principal and interest falling due from 01 June 2020 onwards shall be due and demandable.

- The termination of the grant of the 30-day grace period for the payment of loans with maturity dates on or subsequent to 01 June 2020 is premised on the lifting of the restrictions on economic activities in majority of the provinces and cities in the country. With the lifting of the ECG in majority of the provinces and cities, the condition for the grant of the 30-day grace period under Sec. 4(aa) of Republic Act No. 11469 is no longer present.

2. Will the 30-day mandatory grace period under the Bayanihan Act still apply to loan and/or interest payments falling due until 31 May 2020 even if the new due dates will fall on or before 1 June 2020?

- Yes. The 30-day mandatory grace period under the Bayanihan Act shall continue to apply to land and/or interest payments falling due until 31 May 2020.

3. Pursuant to IATF Resolution No. 40 dated 27 May 2020, ECQ/MECQ is lifted in majority of provinces and cities effective 1 June 2020. Are the borrowers required to pay in June 2020 all loan payments that were granted 30-day grace period in March, April and May 2020?

- No. As stated in item 10 of the FAQs contained in Memorandum No. M-2020-018, the 30-day mandatory grace period under the law has the effect of moving the payment due date by 30 days. Item 11 of the same memorandum also clarifies that the amortization will be effectively rescheduled in accordance with the 30-day grace period. Thus, effective 1 June 2020, the borrower shall only pay the amount of the loan principal and/or interest that is effectively due in June 2020 or for one month following the application of the 30-day grace period. The last payment due date of the loan is effectively extended by a period equivalent to the grace period granted for the duration of the ECQ. For accrued interest in March, April and May 2020, the borrower may pay it in lumpsum in June 2020 or on a staggered basis over the remaining term of the loan.

4. Can covered institutions set a deadline for payment of interest accrued during the mandatory grace period?

- Under the IRR of the Bayanihan Act, borrowers have the option to pay the interest accrued during the mandatory grace period in lumpsum on the next payment due date or on staggered basis over the remaining life of the loan. Covered institutions may offer less onerous payment terms, with the consent of the borrower, that include setting new payment due dates for interest accrued during the mandatory grace period.

5. Can covered institutions impose additional Documentary Stamp Tax (DST) for credit extensions/ restricting granted during the ECQ/MECQ period?

- No. Section 5.01 of the IRR of the Bayanihan Act IRR provides that “no DST shall be imposed on credit extension and credit restructuring, micro-lending including those obtained from pawnshops and extensions thereof during the ECQ period.” The Bureau of Internal Revenue has issued Revenue Regulations No. 8-2020 dated 01 April 2020 and Revenue Memorandum Circular Nos. 35-2020 dated 02 April 2020 and 36-2020 dated 03 April 2020 to this effect.

For information and compliance.

BENJAMIN E. DIOKNO, Governor

01 June 2020

- Extension of Filing Periods and Suspension of Hearings for March 29 to April 4, 2021: SC Administrative Circular No. 14-2021 (Full Text) - March 28, 2021

- ECQ Bubble for NCR, Bulacan, Cavite, Laguna and Rizal: Resolution No. 106-A (Full Text) - March 27, 2021

- Guidelines on the Administration of COVID-19 Vaccines in the Workplaces (Labor Advisory No. 3) - March 12, 2021