[Full text of Revenue Memorandum Circular No. 61-2020 issued by the Bureau of Internal Revenue (BIR), providing for further extension of deadline on availment of tax amnesty on delinquencies from from 22 June 2020 to 31 December 2020.]

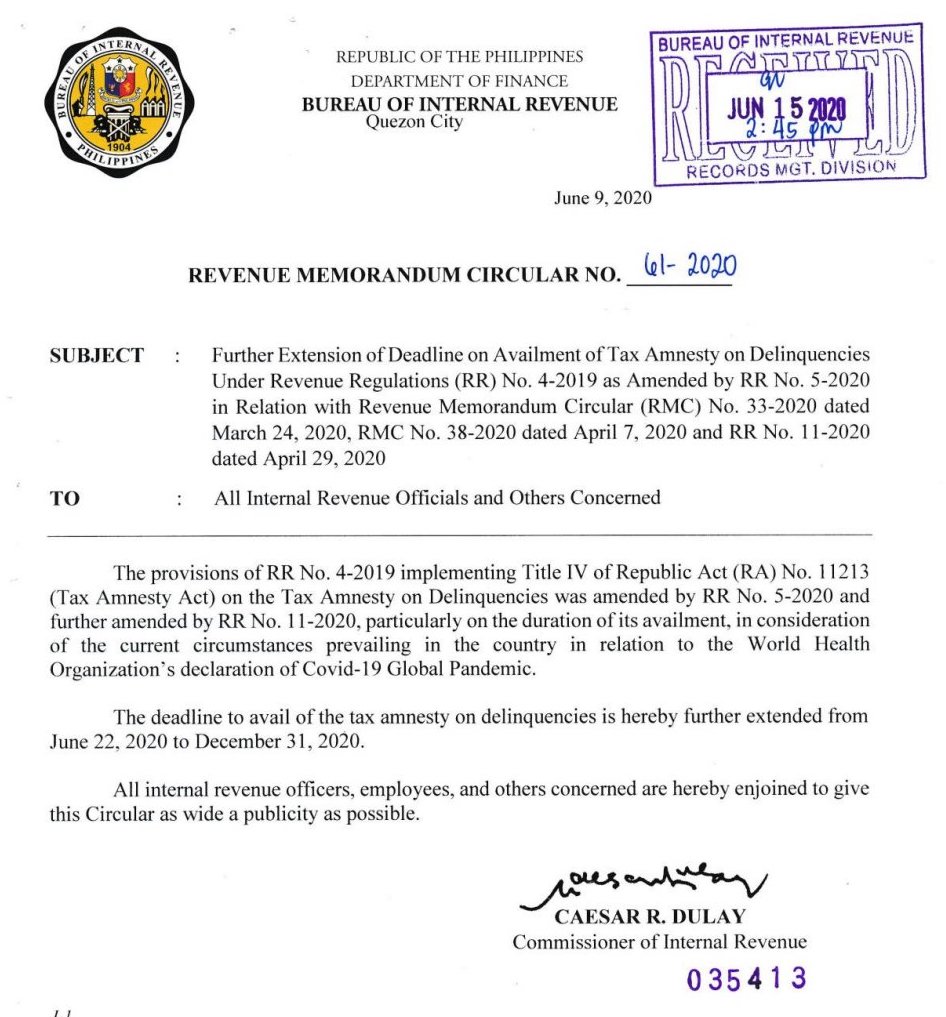

9 June 2020

REVENUE MEMORANDUM CIRCULAR NO. 61-2020

SUBJECT : Further Extension of Deadline on Availment of Tax Amnesty on Delinquencies Under Revenue Regulations (RR) No. 4-2019 as Amended by RR No. 5-2020 in Relation with Revenue Memorandum Circular (RMC) No. 33-2020 dated March 24, 2020, RMC No. 38-2020 dated April 7, 2020 and RR No. 11-2020 dated April 29, 2020.

TO : All Internal Revenue Officials and Others Concerned

The provisions of RR No. 4-2019 implementing Title IV of Republic Act (RA) No. 11213 (Tax Amnesty Act) on the Tax Amnesty on Delinquencies was amended by RR No. 5-2020 and further amended by RR No. 11-2020, particularly on the duration of its availment, in consideration of the current circumstances prevailing in the country in relation to the World Health Organization’s declaration of Covid-19 Global Pandemic.

The deadline to avail of the tax amnesty on delinquencies is hereby further extended from June 22, 2020 to December 31, 2020.

All internal revenue officers, employees, and others concerned are hereby enjoined to give this Circular as wide a publicity as possible.

CAESAR R. DULAY, Commissioner of Internal Revenue

- Extension of Filing Periods and Suspension of Hearings for March 29 to April 4, 2021: SC Administrative Circular No. 14-2021 (Full Text) - March 28, 2021

- ECQ Bubble for NCR, Bulacan, Cavite, Laguna and Rizal: Resolution No. 106-A (Full Text) - March 27, 2021

- Guidelines on the Administration of COVID-19 Vaccines in the Workplaces (Labor Advisory No. 3) - March 12, 2021

Hi Atty,

What is the effect of this RMC on the withdrawal of protest (manual/online)? is it also deemed extended?